Today, some institutions have to face the need to provide an explanation to the tax authorities after any audit or reporting. To ensure that explanations do not provoke additional checks by the supervisory authority, the preparation of the explanation must be taken very seriously, with full responsibility, and not delay in responding.

What requirements are relevant now?

As a rule, the requirement to provide explanations arises after a certain period after reports or declarations, and the reason for the requirement may be any erroneous entry or inaccuracy in reporting. Quite often, questions arise from supervisory structures regarding reporting for VAT refunds when counterparties’ reports do not match, due to discrepancies in tax data in income tax returns. Questions may also arise as a result of unjustified losses of the enterprise during an audit, when sending an updated declaration or in tax reporting, in which the tax amount is shown to be less than in the initial information, etc.

For example, for VAT there are 3 main types of requirements for writing explanations, a sample of which was developed and approved electronically by the Federal Tax Service standards:

- According to control compliance

- For disagreements with counterparties

- About information not recorded in the sales journal (letter of the Federal Tax Service No. ED-4-15/5752 dated 04/07/2015).

Requirements for explanations after VAT returns may arise for other reasons, but a sample document has not yet been developed by the tax authorities.

To send a response, the payer has 6 working days to report receipt of the request, plus another 5 working days to send a response to the request (weekends and holidays are not taken into account).

How to write explanations to the tax office in 2019

If the payer has received a request from the tax service for an explanation, then the inspectorate has found something suspicious in the payer’s declaration. It should be noted that the Federal Tax Service Inspectorate provides desk control of all declarations and accounting reports using an automatic electronic program that can quickly identify errors in reporting (discrepancies between data in reports, discrepancies between the submitted declaration and the information available to the assigned inspector), as a result of which the Federal Tax Service Inspectorate submits a request for an explanation of this fact (clause 3 of Article 88 of the Tax Code of the Russian Federation). There may be other reasons for submitting a request for explanation.

The explanatory note to the Federal Tax Service is drawn up in free form, except for explanations during the desk audit of the VAT declaration. If the payer believes that there are no inaccuracies or inconsistencies in the sent report, then this should be indicated in the explanation of the requirement:

« ...In response to your request No. 75 dated March 2, 2019, we report that there are no inaccuracies in the tax return for the requested time. Based on this, we consider it unacceptable to make corrections to the reporting for the specified time...».

If you discover an error in reporting that does not entail a tax reduction (for example, a technical inaccuracy in displaying a code), you can explain what error was made, indicate the correct code and provide evidence that this inaccuracy did not lead to a reduction in the amount of tax paid or send an updated declaration.

However, if an inaccuracy is discovered that results in a tax reduction, an amended return must be submitted immediately. It makes no sense to give explanations under such circumstances (clause 1 of Article 81 of the Tax Code of the Russian Federation; Letter of the Federal Tax Service No. ED-4-15/19395 dated November 6, 2015).

Every taxpayer is obliged to know that the legislation does not provide that explanations must be submitted only in writing, i.e. this suggests that explanations can be provided orally, however, to avoid any misunderstandings, it is better to prepare a written response.

Explanation to the tax office regarding losses

When checking unprofitable enterprises, the tax service carefully examines whether income taxes are underestimated. The audit period covers the past two years or more. When a taxpayer receives a request to explain the cause of losses, it is necessary to promptly send a response to the supervisory service, which explains in detail why costs are higher than income. For example, you can refer to the fact that the company was created recently, there is still little clientele, and the costs of renting the building and maintaining employees are high, etc. In the answer, it is necessary to pay attention to the fact that all costs are documented and the reporting is drawn up correctly. For greater clarity, you can create a table displaying a list of costs for the year broken down by operations.

Download the explanatory note to the tax office on losses

(Video: “We draw up explanations of losses in response to the request of the tax authority”)

Explanation to the tax office about discrepancies in declarations

Supervisory structures check all declarations using automatic programs, and they can very quickly find a discrepancy between the information in one declaration (for example, for VAT) with the information for another (for example, for income tax) or with the accounting report. In this case, the inspection is forced to contact the payer with a demand to explain the reason for the discrepancy between indicators (for example, revenue).

Considering that accounting in institutions is not carried out in the same order as accounting in the supervisory service, it is not difficult to explain the identified discrepancies. For example, VAT tax data may not coincide with the amount of profit, since there are non-sales income that is not subject to VAT (fines, dividends, exchange rate discrepancies). This circumstance may cause discrepancies, which should be written about in the response to the request. (Article 250 of the Tax Code of the Russian Federation).

Explanation from the Federal Tax Service on VAT

When drawing up explanations to the Federal Tax Service regarding VAT, you must keep in mind that there are some nuances here. As noted earlier, payers are required to submit a declaration in electronic form (clause 3 of Article 88 of the Tax Code of the Russian Federation), therefore, explanations for VAT by institutions are required to be submitted in electronic form. In this case, explanations are required to be submitted according to the accepted template (Federal Tax Regulation No. ММВ-7-15/682@ dated December 16, 2016) and if an institution submits electronic explanations not in the required template, then it may be fined (Clause 1 of Article 129.1 of the Tax Code RF). However, in September 2017, the Federal Tax Service issued a resolution No. SA-4-9/18214@) dated September 13, 2017, which canceled the fine to the payer for an incorrect sample of explanations.

If an enterprise has the right to submit a VAT return in paper form, then it is better to provide explanations according to the samples accepted by the Federal Tax Service (Appendices 2.1-2.9 to the Federal Tax Service letter No. AS-4-2/12705 dated July 16, 2013). It should be noted that the use of these samples is not necessary.

To make the explanation more reliable, you can attach copies of invoices, extracts from sales and purchase logs.

If an inspector demands an explanation from an enterprise about the low tax burden compared to the industry average, then this circumstance can be explained as follows:

“...In the declaration for the required reporting for the requested time, there was no incomplete display of information that would lead to a reduction in tax payments. Therefore, the company believes that clarification of the tax return for the specified time is not required. The tax burden on the main activities of the institution was reduced at the specified time due to a decrease in income and an increase in the institution’s costs...».

And then you need to state the amount of decrease in the amount of revenue and increase in expenses for the requested time compared to the past period, and the reasons for this circumstance (decrease in the number of buyers, increase in prices for the purchase of goods, etc.).

(Video: “UNP News – Issue 8″)

What to do when the tax demand is unfair

There are times when tax structures require explanations when there are no reporting errors. There is no need to ignore such requirements from the tax office. In order to avoid misunderstandings and not be subject to sanctions (including unexpected inspections by supervisory services), it is required to immediately notify the inspectorate that all submitted reports are correct and, if possible, provide copies of supporting documents. We must remember that for the inspection, it is not the text of the explanation that plays an important role, but the fact of the answer itself.

Sample of a response to a tax request for clarification

As noted earlier, there is no unified sample response to an inspection requirement, so you can write an explanatory note in any form. Of course, the text of the response must be displayed in the correct business style adopted for official letters.

- First, usually in the upper right corner, you need to write the address of the tax office, where the institution must provide an explanation. Next, write the letter number, locality and district to which the institution belongs.

- The next line displays the data of the sender of the document: name of the institution, address, and contact phone number.

- In the next paragraph of the letter, before drawing up the text of the explanation, you need to display a link to the number and date of the request by the inspectorate and succinctly describe the essence of their requirement, and only after that you need to start describing the explanations.

- The explanation must be described very carefully, providing the necessary links to supporting materials, certificates, legislation, regulatory documents, etc. The clearer this section of the explanation is, the greater the hope that the controlled body will be satisfied with the answer.

- In the explanation, it is strictly forbidden to refer to unreliable data, as this will be quickly identified with subsequent severe sanctions from tax inspectors.

From this year, you can only respond to tax authorities’ demands electronically. A new format for sending explanations to the VAT return has also been adopted. In the article you will find instructions on how to respond to requirements, and also learn what nuances there are when responding to different types of requirements.

Instructions for responding to tax demands for VAT returns

You have received a request from the tax office to provide explanations on your return. What are your next steps:

Step 1. You must send the receipt within 6 days from the date of receipt (Clause 5.1, Article 23 of the Tax Code of the Russian Federation). If you have not done this within the allotted time, then the inspectors have the right, within 10 days after the deadline for transmitting receipts, to make a decision to suspend transactions on the accounts (clause 3 of Article 76 of the Tax Code of the Russian Federation).

Step 2. Check which form to send the explanation. The company must provide electronic explanations if the inspectors have requested them on the basis of clause 3 of Art. 88 Tax Code of the Russian Federation. The company has the right to send explanations and other requirements on paper if it submitted a paper declaration.

Step 3. Find out what discrepancies need to be explained. To do this, tax authorities in their request indicate errors made by the payer using special coding. For example, for control ratios that are missing in the sales book, invoices, discrepancies in the purchase book, etc. For this purpose, tax authorities use special coding in their request.

- Error code 1 means that: there is no record of the transaction in the counterparty’s tax return; the counterparty did not report value added tax for the same period; the counterparty's tax return contains zero figures; errors made in the report do not make it possible to identify the invoice and compare it with the data of the counterparty’s declaration.

- Error code 2 means that the transaction data between section 8 “Information from the purchase book” and section 9 “Information from the sales book” of the tax return for the reporting period has discrepancies. This can happen if the amount of tax on advance invoices calculated earlier was accepted for deduction. In this case, clarification on advances is necessary.

- Error code 3 means that the data on transactions between section 10 “Information from the log of issued invoices” and section 11 “Information from the log of received invoices” of the tax return submitted to the tax authority do not correspond to each other. This can happen, for example, when entering information about intermediary operations into the declaration.

- Error code 4 indicates an error in any column of the declaration (the number of the column with a possible error will be indicated in parentheses).

Step 4. Prepare and send explanations.

There are no errors. To clarify that there are no errors, do not change the information on the form. This way the company will report that everything in the invoice and declaration is correct.

There are mistakes, but the company did not underestimate the tax. Specify incorrect details in the explanations without submitting an updated declaration. Typical errors: incorrect operation code; incorrect details; different cost of goods.

There is a mistake and the tax is underestimated. There is no need to respond to the request. Make corrections in the books of purchases and sales and submit an updated declaration.

No invoice. The supplier must fill out separate tables (new declaration form, approved by order of the Federal Tax Service of Russia dated December 20, 2016 No. ММВ-7-3/696@).

Attention! Explanations or an updated tax return are submitted to the tax authority within 5 days from the date of receipt of the request. Together with explanations, the taxpayer has the right, in accordance with paragraph 4 of Art. 88 of the Tax Code of the Russian Federation, additionally submit documents confirming the accuracy of the data included in the tax return.

How it turned out in practice: Almost no one receives error code 3. Until now, the Federal Tax Service has not exercised proper control in terms of checking inconsistencies in invoices when purchases and sales take place through intermediaries. Starting this year, control will be tightened. All amendments have been made to internal regulations, the software has been developed, and now tax authorities will check more strictly and thoroughly if GWS is being sold through intermediaries.

How to write explanations when responding to tax requirements

The taxpayer has the right to provide explanations on VAT to the return in free form. Although officials have prudently developed a sample explanation for VAT, which, if desired, can be used. This document consists of several tables in which you can indicate accounting data and document details, as well as explain the reasons for the discrepancies. Each table is dedicated to a specific topic. For example, there are explanations for the high share of VAT. Before filling out a document, you must write an introductory note to it. It indicates by whom and for what tax period the response to the tax office’s VAT explanations was given, and also provides the number of sheets of the document and the correction number.

for accountants and chief accountants on OSNO and USN. Complete training and confirm your compliance with the professional standard “Accountant”

An example of filling out an explanation of control ratios

If you have a violation of the control ratio, then you will indicate the control ratio number and provide an explanation. Please keep your explanation to 1000 characters.

If, as a result of checking the requirements for control ratios, errors are identified that lead to changes in the value indicators of the tax return, then it will be necessary to provide an updated tax return.

Explanations of information not included in the sales book

Those. the absence in section 9 of a registration entry on the invoice, for which the counterparty reflected the corresponding registration entry in section 8 of the tax return.

Case 1. The transaction is confirmed, i.e. There is no invoice in the seller's declaration. No explanations are provided; an updated declaration must be submitted.

Case 2. The transaction is not confirmed, i.e. The seller did not issue this invoice to the buyer.

Updated VAT return

First rule. Before submitting it, you need to adjust the purchase books, sales books, and journals. It all depends on what kind of operation it is.

Three times the rule. You must submit all those sections that were in the original declaration, even if you do not make any changes to them. The updated declaration is submitted in the form that was in force in the period for which you will submit the “updated” declaration. If a new declaration form is currently in force, then we submit the clarification according to the old one.

There is no need to submit explanations when submitting an updated declaration.

Errors. In the appendices to sections 8 and 9 and sections 10, 11, 12 there is a line “Indicator of the relevance of previously provided information” with the value 001. This is necessary so that the machine that processes the data understands what information has been received. If you put 1, this means that you can pass sections 8 and 9 without entries on all invoices, with dashes. By doing so, you are saying that you are not making any changes to this section. If you put 0, then you give a signal to the machine that everything in this section is new. Thus, the rule is as follows: if you submit the primary declaration, put 0, if you submit an adjustment, put 1 (if there is an error in the invoices, then section 8 with attribute 1).

If you make a change after submitting reports for 2015 or 2016, then you must create an additional sheet in both the purchase book and the sales book. You will already be cleaning in it, i.e. cancel entries for invoices that you withdraw and enter those invoices that you will need to enter into the purchase book or sales book. In order for you not to repeat sections 8 and 9, appendices 1 to sections 8 and 9 were provided - this is all the information from the additional sheets.

38,024 views

Based on the results of a desk audit, the taxpayer may receive a request from the inspectorate to clarify any information specified in the VAT return. From January 1, 2017, it is necessary to respond to such a requirement only in electronic form. For example, such an opportunity is available in the service for sending reports

To date, the Federal Tax Service has approved electronic formats for three types of requirements for the provision of explanations on VAT (letter of the Federal Tax Service dated 04/07/2015 No. ED-4-15/5752). These are requirements for control ratios, for discrepancies with counterparties and requirements for information not included in the sales book.

Let's look at what each of them includes and what a taxpayer should do if he receives such a demand.

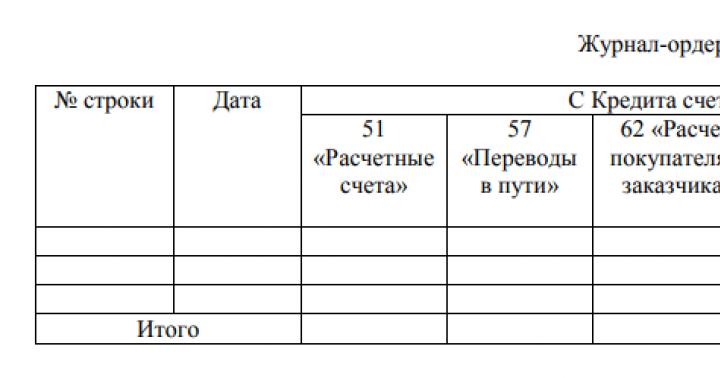

| Explanation type | Explanation of reference ratios | Explanations for discrepancies with counterparties |

| If the tax authority calculates the control ratios in the declaration and finds inaccuracies | If, during the reconciliation of invoices of buyers and sellers, no counterparty is found or discrepancies are discovered in the data (for example, in VAT) | |

| When will it come | Within 1–2 days after sending the declaration. Theoretically, the request can be received during all three months of the audit, but in practice the tax authorities cope with the task within a day or two after sending the declarations | Typically within two weeks after sending the declaration |

| In what format will it come? | pdf + xml | |

| What it contains | - Reference ratio number (eg 1.27). - Formulation of the violation (for example, “overstatement of the amount of VAT subject to deduction”). - Reference to the norm of legislation (Tax Code of the Russian Federation, Art. 171, 172). - Control ratio (Art. 190 R.3 + sum of Art. 030 and 040 R.4 + Art. 080 and 090 R.5 + Art. 060 R.6 + Art. 090 R.6 + Art. 150 R.6 = st. 190 rub. 8 + [st. 190 adj. 8 – st. 005 adj. 8] if the left side of the equation is > right). - Data reflected in the declaration (1781114.00 | - List of invoices for which discrepancies were found that require explanation. - Error codes. For example: 1 - the counterparty does not have a record of the transaction; 2 - discrepancy between transaction data between the purchase book and the sales book. In particular, between the data in section 8 (information from the purchase book) or appendix 1 to section 8 (information from additional sheets of the purchase book) and section 9 (information from the sales book) or appendix 1 to section 9 (information from additional sheets of the sales book) taxpayer declarations; 3 - discrepancy between transaction data between section 10 (information from the journal of issued invoices) and section 11 (information from the journal of received invoices) of the taxpayer’s declaration; 4 (a, b) - an error in columns a, b is possible (the number of the columns in which errors were made is indicated) |

| - Number of the control ratio, to which an explanation is given. - The explanation itself in free form | The original invoices mentioned in the requirement must be raised. And check the data - further actions depend on the results of the check: - The data turned out to be correct. Confirm that the data is correct; it would not hurt to attach a scan of the invoice or the original in electronic format (xml). Don't forget to include the attached documents in your inventory. - An error was detected in the invoice details (date, number, tax identification number, checkpoint, etc.). Make changes in the response to the request (except for the VAT amount). - Error in the tax amount. You will have to submit an updated declaration, and within the allotted five-day period after sending the receipt |

Requiring explanations for discrepancies has several important features. Thus, it may contain erroneous invoices from several sections of the VAT return. As part of a desk audit of one declaration, several requirements of this type may be received. Finally, a request for clarification regarding a particular invoice is sent to both the buyer and the seller at the same time.

Explanation of information not included in the sales book

The procedure for responding to requirements of this type has not been officially approved, so we have included expert recommendations in this table.

| Explanation type | Explanation of information not included in the sales book |

| In what case will the demand come? | When the buyer reflects transactions with the seller in the declaration, but the seller does not do this in his sales book |

| When will it come | Theoretically, such requests can be received within three months of verification, but it is more likely that the demand will arrive within two weeks from the date of sending the declaration |

| In what format will it come? | |

| What it contains | Name, INN and KPP of the buyer who reflected the transaction data, as well as invoice numbers and dates |

| What to include in an email response | The data should fall into different tables in response to the requirement depending on the conditions given below. - The transaction is confirmed, that is, there is an invoice in the declaration, but with data different from the buyer’s data. The invoice then goes into a table that explains the discrepancies. In the table, it is enough to indicate the number, date and TIN of the counterparty; additional information is not necessary. - The transaction is not confirmed, that is, the seller did not issue this invoice to the buyer. The invoice is included in a table containing data on unconfirmed transactions. The table should reflect the following information: – invoice number; – invoice date; – Buyer’s TIN. - The payer has the invoice mentioned in the request, but he forgot to reflect it in the sales book. In this case, we advise you to include the invoice in an additional sheet of the sales book and send an updated declaration. Five working days are given for this after sending the receipt of acceptance of the request |

If you receive a request...

...then you must send a receipt within six business days to accept the claim, after which you have five business days to respond to the claim (weekends and public holidays do not count).

Sanctions

For failure to provide or untimely provision of explanations, a fine of 5,000 rubles is provided. Please note that a response to a request sent to the inspection in paper form is considered not submitted (Article 88 of Federal Law No. 130-FZ dated May 1, 2016).

Report and respond to demands for 1,500 rubles per year!

Submitting reports to the Federal Tax Service and the Pension Fund of the Russian Federation is very simple. Prepare a report in your program, upload it to a service that will check the file for compliance with the law, then sign and send. If you have received a request for clarification on VAT from the tax office, fill out the clarification and send it to the inspectorate electronically. All service features start from 1,500 rubles * per year. Zero reporting is even cheaper. Submit zero reports to the Federal Tax Service, Pension Fund, Social Insurance Fund and Rosstat for 500 rubles per year!

Elizaveta Bulavina, expert at the Report.ru service of SKB Kontur.

*check the price for your region on the website

L.A. Elina, economist-accountant

Cameral: we provide explanations on the VAT return

The topic of the article was suggested by Elena Sergeevna Shatalova, Chief Accountant of Technolux Metal Company LLC, Moscow.

The electronic form for submitting a VAT return has opened up new opportunities for tax authorities for desk audits. In addition to trivial errors in the declaration itself, inspectors are interested in the identified discrepancies between information about transactions contained in the VAT return of one taxpayer and information about the same transactions reflected in the VAT reports of other organizations and entrepreneurs. The verification program automatically compares the data and also automatically generates a request for clarification if any inaccuracies are found.

Received an electronic request - do not forget to send an acceptance receipt

If you submitted your VAT return electronically, then the inspection will send an electronic request for explanations. Having received it, no later than 6 working days from the date of its dispatch, you need to submit a receipt to the inspection clause 6 art. 6.1, clause 5.1 art. 23, paragraph 5 of Art. 174 Tax Code of the Russian Federation.

If you do not do this, within 10 working days from the date of expiration of the period established for the transfer of the receipt, the inspection may block your current account and electronic wallet (if you have one) clause 6 art. 6.1, clause 1, sub. 2 clause 3, clause 11 art. 76 Tax Code of the Russian Federation.

We are studying the requirement to provide explanations and its annexes

Carefully read not only the requirement itself, but also its annexes appendices 2.1-2.9 to the Letter of the Federal Tax Service dated July 16, 2013 No. AS-4-2/12705 (hereinafter referred to as the Letter of the Federal Tax Service). It won’t be difficult to understand what the tax authorities want from you. For example, if the inspection reveals a discrepancy between the data reflected in different lines of sections 1-7 of the declaration, the inspection request will contain the following appendix approved Letter from the Federal Tax Service according to form 2.9.

The desk tax audit revealed the following information about identified contradictions in the tax return for value added tax or inconsistencies between the information provided by the taxpayer and the information contained in the documents available to the tax authority:

| Formulation of the violation | Link to legal norm | Control ratio | Data reflected in the declaration |

| 1 | 2 | 3 | 4 |

| Understatement of the amount of VAT calculated for payment to the budget according to the river. 3 | Art. 173 Tax Code of the Russian Federation | if p. 3 tbsp. 200 gr. 3 r. 3. Art. (110 gr. 5 – 190 gr. 3) In section 3 of the VAT return, the indicator in column 3, line 200 “Total amount of tax payable to the budget under section 3” must be equal to the difference between the indicator in column 5, line 110 “Total amount of tax, calculated taking into account the restored tax amounts...” and the indicator columns 3 lines 190 “Total amount of tax subject to deduction” | RUB 80,000.00 RUB 90,000.00 In the submitted declaration, the difference between the indicators of section 3 on line 110 (column 5) and line 190 (column 3) is equal to 90,000 rubles, which is more than the indicator of 80,000 rubles reflected in line 200 (column 3). And this shouldn't happen |

If inspectors find that some transactions are not reflected in your declaration at all and VAT was not calculated on them, you can receive such an attachment to the request.

According to the information contained in the documents available to the tax authority and received by it during tax control,

in 3 sq. In 2015, the following operations were carried out:

issued

Invoice No. 91 dated September 15, 2015;

According to the information available to the tax authority, the specified transactions are subject to taxation with value added tax, while the specified transactions were not reflected

in the tax return for value added tax.

If the tax authorities have any doubts regarding the information from sections 8-12 of the VAT return, you can receive attachments in tabular form. They are similar to the tables of the corresponding sections of the declaration. The last column of such tabular applications indicates a possible error code. It contains the claims of the inspectors. So, a total of four such codes are now used Letter of the Federal Tax Service dated November 6, 2015 No. ED-4-15/19395.

Code "1". The counterparty does not have a similar record of the transaction, or errors made do not allow us to identify the invoice record and, accordingly, compare it with the counterparty’s data.

For example, you reflected in section 8 of the declaration “Information from the purchase book...” the invoice of the counterparty, but there is no data about this invoice in his declaration. If you really made a mistake, submit an amended return.

But other options are also possible. For example, when registering your invoice, your counterparty incorrectly indicated its date and number, and even registered it a quarter later than you reflected the sale. In this case, explain the current situation to the inspectorate, indicating in which declaration you reflected the invoice that raised doubts. It would be useful to attach a copy of such an invoice to the explanations.

Code "2". It can only appear in cases where data for the same transaction is reflected in both the purchase book and the sales book, but does not correspond to each other.

For example, when leasing municipal property, an organization must first calculate VAT as a tax agent, issue an invoice, pay the tax to the budget, and then accept the same tax as a deduction based on it. In case of discrepancies in the records for such transactions, the inspection may attach two tables to the request for the submission of documents: one with an extract from Section 8/Appendix 1 thereto, the second with an extract from Section 9/Appendix 1 thereto. Look for related operations in them, next to which there is a possible error code “2”, and explain the inconsistencies.

In some cases, one table may be attached to the requirement. For example, the seller declared in the declaration the deduction of advance VAT, but the declaration does not contain data on its accrual. The inspection will send such a seller a table with an extract from section 8 “Information from the purchase book...”, where the registered invoice for the advance payment with error code “2” will be indicated. Check whether you charged VAT on the advance, in what period and whether this is reflected in the VAT return.

Code "3". Inconsistency of data about one transaction in parts 1 and 2 of the log of issued and received invoices. It is conducted for intermediary operations, as well as for the operations of developers and freight forwarders (if they include only their remuneration in revenue).

For example, an intermediary commission agent must register in part 2 of the accounting journal an invoice received from the principal. And invoices issued to customers must be reflected in part 1 of the accounting journal. Data on invoices received and issued within the same intermediary transaction must be comparable. If there are discrepancies, the inspection will attach to its request a table with an extract from section 10 “Information from the log of issued invoices” and/or a table with an extract from section 11 “Information from the log of received invoices” indicating information on “problematic » operations by entering code “3” in the corresponding lines.

Code "4". It is possible that when registering an invoice, an error was made in the indicators indicated in the application columns numbered “a”, “b”.

This type of error is the most common. If the error is in only one column, then one number will be indicated in square brackets.

For example, in section 8 of the declaration two invoices are indicated, the details of which the inspectorate doubts: perhaps one has an incorrect date, and the other has a serial number. In this case, the application to the requirement will look like this.

| No. (Line 005) |

Operation type code (Page 010) |

Seller's invoice number (Page 020) |

Seller Invoice Date (Page 030) |

... | Date of registration of goods (works, services), property rights (Page 120) |

Seller's INN (Page 130) |

... | Cost of purchases according to the invoice, difference in cost according to the adjustment invoice (including tax), in the currency of the invoice (Page 170) |

(Page 180) |

For reference: Possible error code |

| 1 | 2 | 3 | 4 | 13 | 14 | 18 | 19 | 20 | ||

| 99 | 01 | 37 | 09.08.2015 | 19.08.2015 | 7713587777 | 70 800 | 10 800 | 4 | ||

| 185 | 01 | 181Data that raises doubts among tax authorities | 24.09.2015 | 24.09.2015 | 7716777788 | 212 400 | 32 400 | 4 The error code helps to understand what tax officials doubt. Code “4” indicates that an error may have been made when registering the invoice. It is explained in parentheses exactly which of his data are in doubt. The number in brackets indicates a column in the same table with a questionable indicator |

We compose explanations

Let's look at examples of how to draw up explanations for a request from the inspection using the forms recommended by the Federal Tax Service Letter from the Federal Tax Service or developed independently.

You must provide clarifications (electronically or in paper form) or make corrections by submitting an updated declaration within 5 working days from the date of receipt of the inspection request and clause 3 art. 88 Tax Code of the Russian Federation.

If you really made a mistake and underestimated the tax, submitting an updated declaration (with preliminary additional payment of arrears and penalties) will save you from paying a fine and subp. 1 clause 4 art. 81 Tax Code of the Russian Federation. Based on the updated declaration, a new desk audit begins, and the verification of the initial declaration is stopped. clause 9.1 art. 88 Tax Code of the Russian Federation.

Submitting an updated declaration as part of a desk audit of the primary declaration before drawing up the report is equivalent to correcting independently discovered errors. After all, since the desk inspection report has not yet been drawn up, the errors and errors discovered by the inspectors have not been recorded. Letter of the Federal Tax Service dated November 20, 2015 No. ED-4-15/20327.

So, as long as the error is not recorded in the desk audit report, you can correct it without a fine, even if it led to underpayment of tax.

If you do not provide explanations and/or an updated declaration, the inspection will make a decision based on the information it has. And if, for example, it considers that you have underestimated the tax base and underpaid the tax, it will fine you Art. 122 Tax Code of the Russian Federation.

Sometimes inspectors scare organization officials with an administrative fine in the amount of 2,000 to 4,000 rubles. in case of failure to provide explanations on time - as for disobedience to a legal requirement para. 2 tbsp. 2.4, part 1 art. 19.4 Code of Administrative Offenses of the Russian Federation.

However, the Federal Tax Service clarified that this responsibility should only apply for failure to appear (in the case of calling officials to the inspection), and not for refusal to give explanations Letter of the Federal Tax Service dated July 17, 2013 No. AS-4-2/12837 (clause 2.3).

The Tax Service website explains how to provide explanations when filing a VAT return. website of the Federal Tax Service of Russia.

Explanations from the Federal Tax Service can be found: Federal Tax Service website→ Taxation in the Russian Federation → Taxes and fees in force in the Russian Federation → VAT → VAT2015Tax officials believe that it is possible to limit oneself to explanations only if, as a result of eliminating shortcomings or inconsistencies, the indicators of line 040 “Amount of tax payable to the budget...” and line 050 “Amount of tax calculated for reimbursement from the budget...” do not change.

If errors are found that lead to an underestimation of the amount of tax payable, you must submit an updated return. clause 1 art. 81 Tax Code of the Russian Federation; clause 3 of the appendix to the Letter of the Federal Tax Service dated November 6, 2015 No. ED-4-15/19395.

In the Federal Tax Service No. 5024 for the city of Krasnogorsk, Moscow region,

located at:

143409, Krasnogorsk, st. Brothers Gorozhankin, 2A

Ref. No. 3 from 11/10/2015

On No. 12 from 05.11.2015

ANSWER

In response to a message received (with a request for clarification) regarding the value added tax declaration submitted for the tax period III quarter of the reporting year 2015 adjustment number: 0,

relevant explanations on 3 sheets are sent.

As we can see, tax authorities propose to make a kind of cover page for the response, from which it can be seen for what reason the explanations are presented and how many sheets they occupy. The Federal Tax Service recommends that substantive explanations be drawn up in the form of separate attachments, especially if such explanations will be presented via telecommunication channels.

Regarding the indicators of sections 1-7 of the declaration, you can draw up both textual explanations and explanations in independently developed tables (if an updated declaration is not required).

For example, some organization indicated in the purchase book an invoice allegedly issued by your organization, but you did not have such a counterparty at all (or there was no specific transaction). Write this in the explanations.

With regard to your indicators reflected in sections 8-12 of the declaration, the tax service recommends indicating explanations separately for each section in tables No. 1 “Information corresponds to primary accounting documents” and No. 2 “Information explaining discrepancies (errors, contradictions, inconsistencies).”

Table No. 1 fill out if any entries in your declaration that raised doubts among the tax authorities were indicated correctly, that is, they correspond to the primary documents and invoices. Having seen the entry in this table, the inspection will understand that you confirm the correctness of the data specified in the declaration and, perhaps, your counterparty made an error in the declaration. After all, when discrepancies are detected, the inspection requires explanations from both parties, and when the counterparty admits the mistake, everything will fall into place.

Let's continue the example discussed above. The inspectorate doubted the invoice number dated September 24, 2015. Let's assume that this number turns out to be correct. To clarify this, you need to fill out table No. 1 of section 8 of the answer.

Section 8 “Information from the purchase book” of the tax return for value added tax, in which errors or inconsistencies are identified.

1. Information corresponds to primary accounting documents

| No. | Operation type code | Seller's invoice number | Seller Invoice Date | ... | Seller's INN | ... | Tax amount on the invoice, difference in the tax amount on the adjustment invoice accepted for deduction, in rubles. and cop. | ... | ||

| 005 | 010 | 020 | 030 | 120 | 130 | 170 | 180 | |||

| 185 | 01 | 181If there were no errors when registering the invoice about which the inspection had doubts, completely transfer the corresponding line from the declaration to Table No. 1 | 24.09.2015 | 24.09.2015 | 7716777788 | 212 400 | 32 400 |

In table No. 2 you correct your errors related to invoice registration. At the same time, in the “Difference” line, transfer from your declaration the information that the inspectorate asked for clarification, and in the “Explanation” line, indicate the correct values only in those columns where there was an error.

So, in the example we are considering, it is clear that the inspection has doubts about the date of invoice No. 37. Let's assume that the date is indeed incorrect. To clarify the error and indicate the correct data, we fill out table No. 2 as follows.

Section 8 “Information from the purchase book” of the tax return for value added tax, in which errors or inconsistencies are identified.

2. Information explaining the discrepancy (errors, contradictions, inconsistencies)

| No. of the line in which the discrepancy was detected | Information type | Operation type code | Seller's invoice number | Seller Invoice Date | ... | Date of registration of goods (works, services), property rights | Seller's TIN | ... | Cost of purchases according to the invoice, difference in cost according to the adjustment invoice (including tax), in the currency of the invoice | Tax amount on the invoice, difference in the tax amount on the adjustment invoice accepted for deduction, in rubles. and cop. (Page 180) |

... |

| A (005) |

B | 010 | 020 | 030 | 120 | 130 | 170 | 180 | |||

| 99 In column A, indicate the serial number of the corrected entry, under which it was reflected in section 8 of your declaration | Divergence | 01 | 37 | 09.08.2015 | 19.08.2015 | 7713587777 | 70 800 | 10 800 | |||

| Explanation | 19.08.2015 In the “Explanation” line, there is no need to duplicate the indicators of the remaining columns (where there were no errors) |

If you will send a response electronically via TKS, make an inventory of the document in approved By Order of the Federal Tax Service dated June 29, 2012 No. ММВ-7-6/465@; Letter from the Federal Tax Service (clause 2.7).

As you understand, you can provide explanations in free form. After all, the forms of explanations approved by the Federal Tax Service are not mandatory, but rather recommended.

Also, at your own request, you can attach copies of documents confirming the completion of transactions that raised doubts among the inspectors to the explanations.

For example, the inspection doubted only the data of two invoices (No. 85 and No. 164), which were registered in the purchase book. No other shortcomings or inconsistencies were found in the declaration. After checking the details of these invoices, the accountant of Knight of the Day LLC discovered that the invoice data was correctly reflected in the purchase book and in section 8 of the declaration.

This can be explained in any form as follows.

ANSWER

to the message (with a request for clarification)

In response to the received request for explanations No. 12 dated November 5, 2015 regarding the VAT return for the third quarter of 2015, Knight of the Day LLC sends explanations.

The purchase book for the third quarter of 2015 contains the correct data for invoices No. 85 dated September 17, 2015 and No. 164 dated July 15, 2015. This is confirmed by copies of these invoices (see attachment).

Application:

1) copy of invoice No. 85 dated September 17, 2015 - on 1 sheet.

2) copy of invoice No. 164 dated July 15, 2015 - on 1 sheet.

It is not necessary to send explanations through a special operator. If it is more convenient for you, you can take them to the inspection in person or send them by mail (by a valuable letter with a list of the contents and with a receipt).

Do not forget that during a desk audit of a VAT return, the inspectorate may request not only explanations, but also invoices, primary and other documents related to transactions, the reflection of which reveals contradictions or inconsistencies leading to an understatement of obligations to the budget. clause 8.1 art. 88 Tax Code of the Russian Federation. And if you received a request to submit documents, but did not comply with it on time, the organization may be fined 200 rubles. for each document not submitted clause 1 art. 126 Tax Code of the Russian Federation.

Accountants could receive clarification requirements for VAT reporting as part of a desk audit almost all year round, since the deadline until recently was 3 months. (starting from September 3, 2018), however, if violations are suspected, it may be extended. In addition, requirements can be raised as part of additional tax control measures, that is, outside the “office” deadlines. So it turns out that as soon as the declaration has been submitted, we are waiting to see if the demand will come. And a new reporting period is already approaching.

Let us remind you that all VAT reporting has long been transferred to in electronic form. All further interaction also occurs via TCS.

Receipt of the request from the Federal Tax Service must be confirmed. The response is given 5 days if clarification is requested, and 10 if documents are required. If you do not respond within the prescribed period, the tax authority may decide to block the current account. If you send an explanation on paper, it will be considered unsubmitted with all the ensuing consequences.

Most often, tax authorities require clarification of VAT reporting in the following cases:

- The control ratios within the declaration did not converge.

- The information contained in the report contradicts the information available to the tax authority.

- The taxpayer claimed VAT benefits.

- The taxpayer claimed VAT for refund.

- There is a suspicion that the tax base is underestimated.

- Required documents are missing.

- The share of VAT deductions is too high.

Exceeding the permissible share of deductions

There is a VAT deduction rate that is safe to declare. It is calculated as a percentage of the deduction amount to the amount of accrued VAT. If the result obtained is less than a certain threshold level, then such a deduction will not raise any questions.

Was installed at level 87,08%. But this is only an approximate figure, which is determined at the federal level. When checking VAT returns, tax authorities are guided by a similar regional indicator.

Response to requirement No.__________from __________

about the presence of a high proportion of deductions in the VAT returnRomashka LLC, in response to request for clarification No. ___________ dated ___________, explains the following.

The main activity of the company is the wholesale of food products. Due to the current situation in the company, the purchase of products was suspended in the first quarter of 2018 and resumed only in the second quarter. In May, the company purchased a large batch of goods for sale, which led to an increase in the share of VAT deductions.

In the third quarter of 2018, the company plans to increase product sales by concluding new supply contracts. This should lead to an increase in revenue subject to VAT and a decrease in the share of deductions.

Transfer of VAT deduction to other periods

The Tax Code allows you to claim partial VAT deduction, as well as transfer it to other tax periods within 3 years. Companies often use this in order not to exceed a safe deduction percentage and not to attract unnecessary attention during a desk audit. However, the following cannot be transferred:

- deductions from advances;

- deductions of the buyer - tax agent;

- deductions for property received as a contribution to the authorized capital;

- travel deductions.

If the deduction is carried over to another period, there will be discrepancies in data between the declaration of the taxpayer and his counterparty. After all, the counterparty will issue an invoice, include the transaction in the VAT base and pay tax in the period in which the transaction took place. And the taxpayer will declare VAT on this transaction in another period.

about the reasons for discrepancies in the VAT returnThe amount of VAT and deductions in the declaration for the second quarter of 2018 is indicated correctly: on line 190 of section 3, the amount of deductions amounted to 3,200,000 rubles.

The discrepancy with the data of the counterparty Lastochka LLC arose due to the transfer of a VAT deduction in the amount of 36,000 rubles from the second quarter of 2018 to the next period on the basis of clause 1.1 of Article 172 of the Tax Code of the Russian Federation.

The counterparty LLC Lastochka presented the tax amount in invoice No. 214 dated May 25, 2018 and included it in the tax base in the second quarter of 2018. Romashka LLC plans to claim a deduction for this invoice in the third quarter of 2018.

Deduction for advance payment received more than 3 years ago

It happens that a company received an advance payment quite a long time ago, but the shipment of goods or provision of services took place only now. Accordingly, the taxpayer claims a deduction in the reporting quarter. And if the advance is received more than 3 years ago, Tax officials demand clarification of this situation. Here's what you should write in response to this:

Response to requirement No. ___________ dated __________

on the deduction from the advance received from the buyerIn April 2015, Kaktus LLC received an advance payment from the counterparty Lastochka LLC in the amount of 236,000 rubles, including VAT of 36,000 rubles. The tax amount was calculated and reflected in the sales book in the first quarter of 2015.

The amount received is an advance payment for the supply of products to be manufactured by our company for Lastochka LLC. However, due to the fact that we were mastering a new production technology, the products were produced and shipped to the counterparty only in June 2018. Therefore, a VAT deduction of 36,000 rubles was reflected by our company in the purchase book in the second quarter of 2018.

In this situation, the three-year period provided for in paragraph 1.1 of Article 172 of the Tax Code of the Russian Federation does not apply.

Deduction of VAT from prepayment if its amount is greater than stated in the contract

The Federal Tax Service and the Ministry of Finance insist that it is possible to deduct VAT from an advance payment only if The conditions for the transfer of advance payment are contained in the contract. Implies a familiar agreement in the form of a separate document. If there is no such agreement or there is no provision for prepayment, then the tax authorities will refuse the deduction.

Arbitrators have different opinions on this matter - there are decisions in which the existence of an agreement in the form of an independent document is recognized as optional. After all, if the company made an advance payment, it means that it confirmed the conclusion of the contract.

However, the tax authorities did not refuse the contract requirement in this case. True, now they consider it acceptable to provide them with a copy rather than the original document.

Thus, if VAT is claimed on an advance payment, the Federal Tax Service may request a contract (copy), in which there must be a condition for prepayment. Otherwise, deductions may not be recognized.

It happens that the contract specifies one advance payment amount, but in fact the buyer transfers more. The Ministry of Finance admitted that in this case VAT can be deducted from the entire prepayment amount actually transferred. But the tax authorities nevertheless request clarification in such a situation.

You can answer something like this:

Response to requirement No. ___________ dated __________

about deduction from the advance payment transferred to the supplierCactus LLC, in response to request for clarification No. ____________ dated _______, explains the following.

In line 150 of section 3, the deduction amount was 36,000 rubles.

In accordance with paragraph 9 of Article 172 of the Tax Code of the Russian Federation, VAT can be deducted from an advance payment if the following conditions are met:

- the seller presented the buyer with an invoice for the amount of the advance payment, which complies with the requirements of paragraph 5.1 of Article 169 of the Tax Code of the Russian Federation;

- An agreement has been concluded between the seller and the buyer, which contains the conditions for advance payment.

These conditions are met in relation to the operation in question.

Our company transferred an advance payment in a larger amount than provided for in the contract, so we claimed a large amount of VAT as a deduction. In accordance with the explanations of the Ministry of Finance given in letter No. 03-07-11/8323 dated February 12, 2018, this deduction procedure does not contradict the requirements of the law. The legality of the deduction is also confirmed by arbitration practice (Resolution of the Arbitration Court No. F04-2547/2016 of June 21, 2016 in case No. A45-18969/2015).

We also inform you that the counterparty calculated VAT on the amount of the advance payment actually transferred by us and reflected it in the sales book and tax return.

If one of the counterparties in the chain has not paid VAT

All VAT payers know how dangerous it is to get involved in a chain with an unscrupulous counterparty. At the same time, it has been a year since the Federal Tax Service has been unable to deduct VAT from a company if it has not committed any violations on its part.

The deduction may be deprived if the facts in accounting and reporting were deliberately distorted, if the transaction was concluded to reduce taxes and did not have a business purpose, or if the counterparty exists only on paper. But to withdraw the deduction, the tax authority must submit evidence that the taxpayer acted in concert with an unscrupulous counterparty.

If the tax authorities demand clarification of a transaction with such a counterparty, you can answer something like this:

Response to requirement No. ___________ dated __________

due diligenceRomashka LLC, in response to request for clarification No. ____________ dated _______, explains the following.

When preparing a transaction with the supplier Lastochka LLC, our company carried out an inspection in accordance with the developed Regulations on the inspection of counterparties.

In particular, we received the following documents from Lastochka LLC:

- charter;

- extract from the Unified State Register of Legal Entities;

- copies of registration certificates, tax registration;

- order on the appointment of the general director;

- certificate of absence of debt to the budget.

During the year, our company reconciled settlements with Lastochka LLC several times.

Thus, we believe that we exercised due diligence when choosing a counterparty. Accordingly, we consider the application of VAT deductions on invoices received from Lastochka LLC to be legal.

Error on invoice

Sometimes tax authorities send requests related to inaccuracies and errors in invoices. It must be remembered that deductions on such invoices can be claimed if errors do not prevent identification:

- seller or buyer;

- name of the product, service;

- price;

- rate or VAT amount.

However, in practice, tax authorities often in this case require the submission of a “clarification” on VAT. Even if it concerns technical errors, for example, in the date or invoice number. If the taxpayer does not submit an updated declaration, he is invited to the inspectorate to provide explanations. Although, according to the arbitrators, in this case it is enough to provide an explanation of the TKS and indicate the correct data. This conclusion is confirmed, for example, in the Resolution of the AS SZO dated 09/01/2017 No. F07-7152/2017 in case No. A13-14539/2016.

An explanation in this case might look like this:

Response to requirement No.___________ dated __________

about an unjustified deduction due to a technical error

in the invoice numberRomashka LLC, in response to request for clarification No. ____________ dated _______, explains the following.

Our company made an error in the invoice number dated 06/06/2018 issued to Lastochka LLC in the amount of 236,000 rubles. The correct invoice number is "14".

At the same time, we inform you that the error in the invoice number did not lead to the impossibility of identifying the necessary parameters of the transaction and to an understatement of tax liabilities for VAT (clause 1 of Article 81 of the Tax Code of the Russian Federation).

We present a scanned copy of the invoice for which we claimed a deduction in the second quarter of 2018. We also inform you that the counterparty Lastochka LLC reflected the specified invoice in the sales book for the second quarter.

Based on this, we believe that our company has fulfilled the requirement of the tax authority. We believe that there is no need to submit an updated VAT return.