It was time for lunch, but for three dozen top managers of the financial corporation (FC) Uralsib, gathered in one of the office rooms, salad and soup were at an unattainable distance. Having exchanged business suits for casual clothes, the managers moved chaotically and changed places, while a thin man with a satisfied smile walked around in jeans and a sweater - the owner of the corporation, Nikolai Tsvetkov. The event was called "arrangement". Each of the managers, after rushing around the room, found “his” place. And now the long-awaited harmony seems to have been achieved. But one of the participants unexpectedly broke the silence - he heard his heart, which was beating not on the left, but on the right. “Tsvetkov interpreted this as a sign that something was going wrong with us,” says a participant in that “arrangement.” “And instead of lunch, we spent an hour or an hour and a half searching for the heart of our organization.” No one expressed dissatisfaction out loud; the shareholder could have paid more generous bonuses to his like-minded people.

Such corporate events were an integral part of the ontological approach to management implemented at FC Uralsib. Ontological management is, according to the theory, management built on the basis of an understanding of the laws of existence and the study of pictures of reality. Vague. With this management method, companies use strategic maps and a system that controls the implementation of the strategy based on key performance indicators (KPIs).

Until 2014, “arrangements” and classes where employees were trained in ontological management were held at Uralsib two to three times a week, sometimes three-day seminars were held that covered Saturday. A former career officer, Tsvetkov is a passionate person; in addition to introducing ontology and then numerology into FC, he went to shamans in Khakassia, practiced yoga and Ayurvedic procedures, and Chinese qigong gymnastics. However, he regularly visits Orthodox church and spends a lot of money on charity. Meanwhile, the capitalization of Uralsib Bank from its peak in 2007 ($7.9 billion) fell to $170 million. How are Tsvetkov’s hobbies and his business connected?

Healthy person number

The first conversation about corporate culture came in 2000. By this time, the Nikoil investment company owned by Tsvetkov had more than 11% of Lukoil shares at its disposal: just over 5% belonged to Tsvetkov himself, the remaining 6% to the president of the oil company, Vagit Alekperov and his partners. Nikoil earned hundreds of millions of dollars on the stock market, and the 1998 crisis only benefited it - Tsvetkov’s company bought the bankrupt competitor Rinako Plus and a little earlier, in 1996, the small bank Rodina.

The company spared no money on employees, but did not grow its personnel, but bought up already formed teams. “People came in groups and began to pursue their own direction. The team from Sber, for example, dealt with precious metals, the guys from Rinaco sat separately and traded shares. The result was some kind of set of boutiques. And then Tsvetkov thought about how to combine all this,” recalls one of the then managers of Nikoil.

The problem really got underway in 2002, when Nikoil acquired Avtobank and Industrial Insurance Company (PSK), for an estimated price of almost $200 million. By that time, all structures of Nikoil IBG had already moved to their own office building on Efremova street in Khamovniki.

The top manager of Avtobank recalls that then Tsvetkov began to instill in the team a love of healthy image life. At first, everyone became interested in healing procedures and therapeutic fasting according to the Paul Bragg system. A wellness center with a massage room and a yoga room was opened on the top floor of the office tower. There, according to the manager of Autobank, there was “a person who cleansed the chakras” for everyone. Tsvetkov and the former owner of the newly purchased PSK, Boris Pastukhov, went to China to improve their health.

Tsvetkov then set himself the task of losing 20 kg. He made it a rule to go up to his office on the 14th floor only on foot and to do yoga regularly. Subordinates had no choice but to follow the example of the president. Some did it with pleasure, but hard times came for overweight people. Former managers recall that in the canteen special tables with mineral water and raw vegetables. There were people who, as soon as they saw Tsvetkov enter the dining room, immediately ran to these tables and grabbed glasses of water, pretending that they were also following a strict diet. Tsvetkov had the impression that he was surrounded by like-minded people.

Another hobby of that time was numerology. The HR service counted the numerological numbers of managers and compared them with Tsvetkov’s number. To calculate, it is enough to know your full name and date of birth. Who was preferred, other things being equal? In 2007, Tsvetkov was looking for a replacement as chairman of the board of Uralsib Bank; the choice was between the two first vice-presidents of the corporation, Vladimir Ryskin and Andrei Donskikh. Ryskin has worked at the corporation since 2002, Donskikh since 2004. Donskikh received the appointment - his numerological numbers were in unison with Tsvetkov’s numbers. Ryskin's results were somewhat worse. According to numerological calculations, Tsvetkov’s compatibility with Donskikh according to the psychomatrix (Pythagorean square) is 100%, and with Ryskin - 88%.

Tsvetkov’s own psychomatrix (numbers 2222 in the Pythagorean square) shows that he has excess energy and psychic capabilities.

Does he himself know about his number 2222? Tsvetkov answered this question from Forbes evasively: “In our Orthodox culture, we are taught to rely on the commandments. I try not to think about anything else.”

“Tsvetkov is a believer, with an open mind and heart,” says a former employee of the Meta Educational Foundation, founded by Tsvetkov’s family. “He simply tries to find the best and most inspiring in various philosophical, psychological and economic teachings around the world.” This employee was involved in preparing materials for ontology workshops.

From East to West

In 2003, the Nikoil group bought the Bashkir Ural-Siberian Bank (Uralsib), the largest regional bank at that time (11th in terms of assets in the country), for $230 million. In September 2005, five banks - IBG Nikoil, Avtobank, Uralsib, Bryansk People's Bank and Kuzbassugolbank - were merged into Uralsib Bank. After the merger, the bank’s capitalization on the stock exchange soared 10-fold, to almost $3 billion. Tsvetkov says that he then felt “satisfaction from the impeccable execution of a very complex organizational and technical task, pride in the result and the team that worked to achieve this result.” As managers from Tsvetkov’s circle at that time say, he felt like a very wealthy man and was in euphoria. Under his direct leadership was a team of thousands, which he wanted to unite. Moreover, half of the leadership lived in Moscow, half in Ufa. “Tsvetkov got a well-built huge bank with a skyscraper in the center of Ufa and with its own corporate culture. This culture was stricter than ours. Then the right move was made - several top managers were transferred from Ufa to Moscow,” recalls a former high-ranking employee of the corporation. People of different religious denominations worked at the bank, and Tsvetkov wanted to find a value system that would not conflict with the beliefs of the employees.

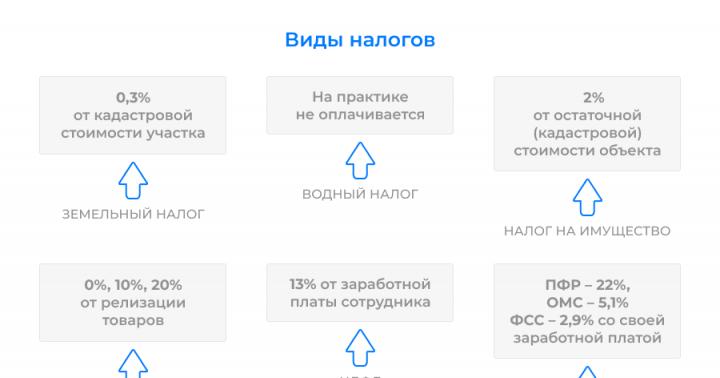

By the beginning of 2006, Uralsib was in fifth place in terms of assets in the country, and one of the three largest players in terms of capital, profit and breadth of the retail network. To develop corporate culture and management, the human resources service (as the HR department is usually called at Uralsib) invited foreign consultants, in particular the Human Factor company. As a result, the bank introduced management methods based on a balanced scorecard and strategic maps.

These techniques were developed by Harvard School of Economics professors Robert Kaplan and David Norton. They proposed a system according to which management decisions should be made on the basis of the company's non-financial indicators, including the degree of customer loyalty and the innovative potential of the enterprise. Their Balanced Score Card methodology defines four main priorities: financial results, customers, potential, processes. For a visual presentation, Kaplan and Norton developed a methodology for drawing up strategic maps (Strategy Mapping), in the West it is used by almost 80% of large companies.

“Tsvetkov wanted to see how it all worked, so that the entire corporation could be seen as if on a big screen. And nothing came of it. The Bashkirs, the smartest ones, drew on their maps what Tsvetkov wanted to see. Donskikh pretended to understand all this,” recalls the former top manager of Uralsib. The balanced scorecard system at Uralsib did not remain classic for long. Tsvetkov decided to improve it, adding a fifth priority - social responsibility and noble motives. “When they introduced the balanced scorecard system, I resisted at first, but then I realized that it disciplines the brain. But soon everything changed - something else began to be attached to the standard system, its original meaning was lost,” says a former manager of Uralsib Bank.

Tsvetkov believes that it was the introduction of the Balanced Score Card that allowed Uralsib to successfully unite teams and corporate cultures. For the successful implementation of the system, Kaplan and Norton accepted Uralsib into the so-called “Hall of Fame.” The list includes hundreds of companies and banks, including BMW, Volvo, Siemens, Motorola, HSBC, Nordea. There are only two Russian ones. Uralsib is owned by the Life financial group; at the beginning of August 2015, the Central Bank revoked the license of Probusinessbank (the main bank of the group).

To prepare a strategy, managers could travel to Mauritius, Oman or the UAE. About 80 people flew on charter and checked into prestigious hotels.

For each such trip, according to a Forbes source, about $3 million was spent. “Tsvetkov insisted that during trips we would work only on strategy for two weeks and not communicate with subordinates, teaching them to be independent. We drew a strategic map, built KPIs, but none of this came to the point of implementation on the ground,” recalls the former manager of Uralsib.

Sometimes during trips, Tsvetkov entertained his subordinates in strange ways. One of them recalls how in Oman, at a farewell banquet, Tsvetkov performed various yoga asanas on a small podium to the music. The President's demonstration performance wearing a traditional Indian headband lasted about an hour. “We walked around, ate and drank something. It was somehow uncomfortable. I didn’t know where to go, I hid behind my colleagues,” recalls one of the show’s viewers.

Uralsib hosted many seminars on different topics and trainings not only for management, but also for ordinary employees. The procedure for participation was voluntary-compulsory. Chiefs were required to ensure the attendance of a certain number of their subordinates. “Tsvetkov parted with managers without mercy if he encountered active resistance from them, even the most effective ones,” says another former Uralsib employee.

The first of the top managers to leave the corporation was the head of the investment block, Igor Kolomeisky. His division earned about $200 million in 2005, and he believed he had earned the right to not attend distracting events. According to one of the managers, Tsvetkov had the following phrase for this case: “They, like leaves, should fall from my tree.” Another “leaf” was the first vice-president of FC Uralsib, Alexander Zhirkov, he headed the pension business of IFD Capital Vagit Alekperov and vice-president of Lukoil Leonid Fedun. Financial director Alexander Torbakhov also resigned.

From West to East

In the mid-2000s, the markets broke record after record, in such a situation any manager becomes effective, the profit and capitalization of Russian banks reached unimaginable heights. In 2007, Tsvetkov reached the peak of wealth - Forbes estimated his fortune at $9 billion. In March, he stepped away from the operational management of the bank, reserving the post of president of the corporation. Later, he sold almost his entire stake in Lukoil to Alekperov, and he parted with a controlling stake in FC Uralsib, leaving himself only 7%. Of the 5.26% stake in Lukoil, Tsvetkov retained 1%, and he resigned from the board of directors of the oil company.

Tsvetkov stopped communicating with the press, and it was difficult to officially find out anything about his motivation. In the summer of 2008, the Forbes editor visited the Kerala Ayurvedic clinic on Novocheremushkinskaya Street.

One day, Tsvetkov came into the rest room, accompanied by an Indian doctor. He lay down on the couch behind the screen and began talking to the doctor. The essence of the conversation: Tsvetkov is not interested in working for profit; he himself sets noble goals and wants to achieve the same from his employees.

The editor of Forbes turned to Tsvetkov, he did not agree to an interview, but brought from the car and gave her the book “I Am That” by Nisargadatta Maharaj, an Advaita teacher. The President of Uralsib noted that he carefully studied this tome and it helps him in life.

At that time, he was also interested in the books of Sergei Neapolitansky (pseudonym Sun Light). Initially, this author, who is called “Dontsova in the world of esotericism,” made translations from Sanskrit, and then began to write books: “Ayurveda for every day”, “Encyclopedia of Ayurveda”, “Energy of Thought”, “Energy of Abundance”, “Matrix of Happiness” . Neapolitansky lived in St. Petersburg. Tsvetkov invited him to Moscow and hired him at the Meta Foundation. The writer prepared materials for ontological seminars and various presentations. Corporation employees were recommended to read his books and take anonymous tests on their knowledge of the material.

At the same time, two more top managers left the bank - Vladimir Ryskin went to Gazprombank, and Alexey Chalenko began managing the assets of Elena Baturina. They wanted to focus on business and did not share Tsvetkov’s hobbies. Loyal employees remained in the bank. Many of them received high rewards. The compensation of the chairman of the board of Uralsib Donskikh, according to Forbes interlocutors, was about $6 million a year, the income of other top managers started from $1 million. Among the highest paid managers were Mikhail Levitsky, Olga Degtyareva, Alexey Sazonov and the head of HR Ekaterina Uspenskaya.

Foundations and children

In 2009, when banks were cutting costs and struggling with the crisis, Tsvetkov met Scotsman Solihin Tom and his wife Alicia, who had converted to Islam, and they began conducting ontological seminars and “constellations” based on their own developments at Uralsib Bank. Solihin and Alicia are followers of the Subud spiritual society, founded by Muhammad Subu Sumohadividjoyo. He explains "the manifestations and operation of the life forces in the language of Islamic theology and Javanese mysticism, rooted in Hinduism." New teachers and authors of the book “Being Human” were hired at the Meta Wellness Center. They patiently explained the essence of their ontological model at numerous seminars and “constellations” that they held at English with simultaneous translation.

This period coincided with the second wave of exodus of managers from Uralsib.

The biggest loss, according to several former managers, was the departure of the bank's chairman of the board, Andrei Donskikh, at the end of 2009.

He became deputy chairman of the board of Sberbank for corporate business. Shortly before this, deputy chairman Dmitry Zotov headed Sberbank Leasing, and another deputy chairman, Jomart Aliyev, got a job at Rosatom.

The crisis and the departure of key employees affected financial results, total losses under IFRS since 2011 amounted to 28.8 billion rubles. At the same time, Tsvetkov continued to withdraw money from the bank and invest it in charitable projects - the Meta Education Foundation alone received 1.06 billion rubles in 2011. In just 10 years of existence, the Meta and Victoria foundations received about $300 million from Tsvetkov. These funds finance the restoration of churches, the construction of houses for families with adopted children and many other projects. Several years ago, Tsvetkov himself took custody of three children who came to the Olympiad organized by Uralsib from different orphanages. Now he has a daughter, Galya (she came from Rubtsovsk Altai Territory) and sons Vanya (Lipetsk) and Lenya (Kirov). “Tsvetkov has an excellent value system. These are not villas, yachts or planes. Only for the bank’s accounting department it doesn’t matter for what purposes the money is spent,” says a former manager of Uralsib.

In 2013, Tsvetkov held an “arrangement” at Expocentre, in which more than a thousand people participated. Uralsib's expenses for personnel development and training in 2013 amounted to about $22 million, the year before they spent $19 million.

Destructive leasing

At the end of 2014, Uralsib’s loss according to IFRS amounted to 9.5 billion rubles. The consolidated reporting is greatly spoiled by the indicators of the leasing business - the loss of Uralsib Leasing amounted to 5.1 billion rubles. This company was established in 1999 and for a long time remained one of the market leaders. Before the 2008 crisis, the leasing division received about 3 billion rubles in authorized capital from the bank. The company planned to become the largest leasing supplier of tanks for the transportation of oil and petroleum products. A former manager of Uralsib says that problems began at the start of the project; the Ukrainian plant Azovmash received an advance payment of $50 million, but was able to deliver 4,000 tanks only a few years later.

In 2009, Oleg Litovkin, who had previously been involved in issuing corporate loans at the bank, was appointed head of Uralsib Leasing. Losses under IFRS first appeared in 2010 and amounted to 1.7 billion rubles; over five years they reached 13 billion rubles, and in the first half of 2015 they grew by another 3.5 billion rubles. At the same time, personnel and rental costs increased. "Uralsib Leasing" moved to the class A business center "White Square". There were also elements of outright negligence. Thus, three Uralsib managers recall that due to confusion, employees forgot to submit documents to the Federal Tax Service for a VAT refund of 400 million rubles.

The total debt of Uralsib Leasing at the end of 2014 was 26 billion rubles, this amount includes a foreign currency loan from VTB Austria for $60 million. The company receives income in rubles, and against the background of the ongoing devaluation, it is increasingly difficult for it to service the foreign currency loan. According to a source close to the bank, Litovkin did not hedge currency risks, although this required just one call. Litovkin himself declined to comment, referring Forbes to the bank’s press service; they did not answer questions about leasing.

According to the former deputy chairman of Uralsib Bank, general director of the leasing company Transfin-M Dmitry Zotov, the problems of Uralsib Leasing are the inability to predict market cyclicality, incompetent management, a weak risk management system and the company’s high administrative costs. “Almost every year, leasing was a generator of problems; no one talked about this division without laughing,” says another former Uralsib employee.

Your own business

While Tsvetkov was looking for and hiring various teachers for managers, they themselves were working on their own projects. Uralsib Capital CEO Mark Temkin was particularly active. His list of interests is wide: he reformatted and sold commercial real estate, owned a furniture production and five restaurants. Not all projects were successful. One of the deals almost cost Temkin his job and almost ruined his reputation. In 2014, he personally provided a loan to the owners of the little-known Zapadny Bank, secured by its shares. At the same time, it was not a big secret that the chairman of the board of directors and the main shareholder of the bank, Dmitry Leus, was sentenced to four years for money laundering in 2004 and was involved in the case of the theft of $20 million from the Central Bank of Turkmenistan, and in 2006 he was released on parole. The Bank of Russia revoked Zapadny’s license on April 21, 2014, estimating the gap between the bank’s assets and liabilities at 12.2 billion rubles. No one returned the money to Temkin, and he became the owner of 22.4% of Zapadny, another 9.95%, according to the same scheme, ended up with the former executive director of Uralsib Bank 121, Nikolai Karpenko.

The previous owners of Zapadny Bank fled, and Temkin not only lost money, but, as his friends say, he found himself under pressure from law enforcement agencies, who offered him to close the bank’s “hole” with his own funds. Temkin did not comment to Forbes by phone, asked to send him questions by email, but did not answer them, and then stopped picking up the phone. Two of his acquaintances say that Temkin was ready to be fired, but nothing terrible happened. Tsvetkov allegedly told him that they were now in the same boat. “If it was possible, the shareholder kept business relations and provided a second chance. The fact that Mark Temkin continues to work at Uralsib means that we trust him,” the Uralsib press service commented on the situation.

There have been stranger cases. According to a former Uralsib employee, one of the bank's managers, Roman Petrov, received tens of thousands of dollars in cash from Tsvetkov to carry out a delicate assignment, and later told him that he had lost the money. A couple of years later, Petrov became chairman of the board of Sodbiznesbank and received four years in prison for deliberate bankruptcy and illegal banking activities. Uralsib does not comment on this case.

The dubious story, which affected dozens of bank employees, took place from 2010 to 2013.

Bank managers knew within a few hours what conversion rate the treasury would set, and depending on the current rate, they sold or bought currency, and then made a reverse transaction. Dozens of bank employees were involved in this scheme.

When it was revealed, a specially created working group demanded that the participants in the scheme return the millions of dollars they had earned. Many refused, some quit. There was no criminal investigation. The treasury of Uralsib was then headed by Alexey Potapov. He now works as deputy chairman of the Federal Corporation for the Development of Small and Medium Enterprises and advised Forbes to contact the press service of this organization. “Tsvetkov continued to forgive everyone and did not sue anyone, and, on the contrary, he brought some closer to himself and wanted them to take the path of correction,” says a former Uralsib employee.

After the successful 2000s, the bank owner himself seemed to have lost his grip. A former employee of Uralsib cites the example of the sale by the Znak company (which managed Tsvetkov’s land assets) of the Krasnogorsk poultry farm for $15 million. Tsvetkov bought this land for $1.5 million. Not a bad return on investment? Capital Group has found GVSU Center as a partner, which is building a 675,000 sq. m poultry farm on the land. m of housing. After completion of the project, Capital Group’s share, according to the source, will be worth at least $200 million.

Lifebuoy

Tsvetkov says he is heavily involved in the process of saving the bank. In 2012, he invited Ilkka Salonen, who headed the Moscow UniCredit from 1998 to 2007, to the role of chairman of the board. He was given the task of making Uralsib profitable. By the end of 2014, Salonen completed cost and personnel reductions, with the number of employees decreasing by 15% over the year. “When I came to Uralsib, there were more than 13,000 employees. I gave my colleagues the example of Unicredit - a bank with one and a half times the balance sheet, but only 3,000 people working there,” says Salonen. The loss of Uralsib according to IFRS in 2014 amounted to 9.5 billion rubles. Salonen left without a bonus.

According to most Forbes interlocutors, Uralsib needed an additional injection of $300 million into capital at the end of 2014. Tsvetkov began looking for money. In May, Vagit Alekperov offered to help him. Terms of the deal are unknown. Tsvetkov delayed his response for a long time, and Alekperov withdrew the offer. Tsvetkov himself found funds to recapitalize the bank.

Since the beginning of the year, 17.6 billion rubles in cash and property have been contributed to the capital. Tsvetkov sold his lands in the Moscow region; for 3,600 hectares he could have gained about 4 billion rubles.

What does Tsvetkov have besides a bank? The companies “Organik” (produces organic dairy products under the “Eto Leto” brand) and “Palisad” (produces rolled lawns), they own about 12,000 hectares of agricultural land. There is the Imperial Porcelain Factory, the Deshoulieres porcelain factory in France, the Meta health corporation and a share (42.6% of shares) in the Azerbaijani investment company Nikoil. Tsvetkov’s stake in Lukoil (about 1%) was contributed to the capital of Uralsib Bank. State former billionaire Forbes estimates today at $250 million. However, money has long been of no importance to him. According to one of the Lukoil managers, Tsvetkov says that he is not afraid of anything and can engage in scientific and teaching activities. The Russian School of Ontology is to open in Moscow.

– Russian entrepreneur, member of the Board of Directors, Chairman of the Board of Directors of FC Uralsib.

Photo: http://www.au92.ru/msg/20030718_q5d1q3d.html

Biography of Nikola Tsvetkova

In 1980 he graduated with honors from the Tambov Higher Military Aviation Engineering School, in 1988 he graduated with a gold medal from the Air Force Academy named after. N. E. Zhukovsky, later - the Russian Economic Academy named after. G. V. Plekhanov (specialty “marketing”).

Candidate of Economic Sciences, reserve lieutenant colonel.

In 1977-1992 he served in the Air Force of the USSR Armed Forces and Russian Federation. Served in Afghanistan and the Far East.

In the early 1990s he taught at the military department of MIREA.

In 1992, he got a job at the investment company Brokinvest.

In 1993, he founded the brokerage company Nikoil, which was involved in the privatization of "".

From 1995 to October 1997 - Vice President of - Head of the Main Directorate for Finance and OJSC Oil Company Lukoil.

In 1995-1996 - member of the Expert Council of the Federal Commission for Securities and the Stock Market (FCSM).

From October 1997 to 1998 - President and Chairman of the Board of Directors of the oil investment company NIKoil.

Since 1997 - President of the Investment Banking Group (IBG) NIKoil.

In 1997 - Advisor to the Chairman of the Board for Investment Banking Operations of JSCB Rodina. Since 1998 - Deputy Chairman of the Board for Investment Banking Operations - Head of the Resource Raising Department of JSCB Rodina.

Since August 1998, he has been Chairman of the Board, member of the Board of Directors, and member of the credit committee of JSCB IBG NIKoil.

Since June 25, 1999 - Chairman of the Board of Directors of the Novorossiysk Commercial Sea Port.

In 2002, he bought the Lomonosov Porcelain Factory for his wife Galina and returned it to its original name. In the same year he acquired the porcelain manufacturer Deshoulieres in France.

Married, two children.

Awards and achievements of Nikolai Tsvetkov

He is the author of more than 30 articles and a number of monographs on the issues of the financial market and investments in the real sector of the economy. Winner of the national business reputation award “Darin” of the Russian Academy of Business and Entrepreneurship in 2002 and 2005.

According to the magazine, at the end of 2014, Tsvetkov took 58th place in the ranking of the richest businessmen in Russia.

Features of Nikolay Tsvetkov

Takes care of the health of all employees of FC Uralsib.

Encourages those who want to lose weight or quit smoking with money. He opened a chain of organic food stores “Bio-Market”, one of them on the territory of the corporation’s central office.

At the end of 2012, he performed at New Year's parties in the companies of FC Uralsib - he sang his songs of philosophical content from the stage.

Charitable activities of Nikola Tsvetkova

In 2014, Tsvetkov’s Victoria Foundation completed the construction of the Victoria Children’s Village in Armavir, where more than 80 orphans will live in foster families. The total cost of the project is 380 million rubles.

, Krasnogorsk district, Moscow region, USSR

K:Wikipedia:Articles without images (type: not specified)Nikolai Alexandrovich Tsvetkov(born May 12, 1960, village of Putilkovo, Krasnogorsk district, Moscow region, USSR) - entrepreneur, head of the Uralsib financial corporation. According to the ranking of “100 Richest Businessmen in Russia 2010,” compiled by the Russian edition of Forbes magazine, Mr. Tsvetkov’s fortune is $3.2 billion.

Biography

Nikolai Tsvetkov was born on May 12, 1960 in the village of Putilkovo, Krasnogorsk district, Moscow region. In 1977 he graduated from Ulyanovsk secondary school.

Since 1992 he has been working in the stock market. He was vice president of the investment company Brokinvest.

Since 1997 - President of the Investment Banking Group (IBG) NIKoil.

In 1997 - Advisor to the Chairman of the Board for Investment Banking Operations of JSCB Rodina. Since 1998 - Deputy Chairman of the Board for Investment Banking Operations - Head of the Resource Raising Department of JSCB Rodina.

Since August 1998 - Chairman of the Board, member of the Board of Directors, member of the credit committee of JSCB IBG NIKoil.

N.A. Tsvetkov - Candidate of Economic Sciences. The topic of the dissertation is “Problems of attracting domestic and foreign investment in the oil and gas industry Russian economy" He is the author of more than 30 articles and a number of monographs on the issues of the financial market and investments in the real sector of the economy. Winner of the national business reputation award “Darin” of the Russian Academy of Business and Entrepreneurship in 2002 and 2005.

Family

Married, two daughters.

See also

- // Magazine “Beaumonde”, No. 05-06 (41-42), March 2001

Write a review of the article "Tsvetkov, Nikolai Alexandrovich"

Notes

Excerpt characterizing Tsvetkov, Nikolai Alexandrovich

Pierre, how is it for the most part it happens that I felt the full weight of the physical deprivations and stresses experienced in captivity only when these stresses and deprivations ended. After his release from captivity, he came to Orel and on the third day of his arrival, while he was going to Kyiv, he fell ill and lay sick in Orel for three months; As the doctors said, he suffered from bilious fever. Despite the fact that the doctors treated him, bled him and gave him medicine to drink, he still recovered.Everything that happened to Pierre from the time of his liberation until his illness left almost no impression on him. He remembered only grey, gloomy, sometimes rainy, sometimes snowy weather, internal physical melancholy, pain in his legs, in his side; remembered the general impression of misfortune and suffering of people; he remembered the curiosity that disturbed him from the officers and generals who questioned him, his efforts to find a carriage and horses, and, most importantly, he remembered his inability to think and feel at that time. On the day of his release, he saw the corpse of Petya Rostov. On the same day, he learned that Prince Andrei had been alive for more than a month after the Battle of Borodino and had only recently died in Yaroslavl, in the Rostov house. And on the same day, Denisov, who reported this news to Pierre, between the conversation mentioned the death of Helen, suggesting that Pierre had known this for a long time. All this seemed strange to Pierre at the time. He felt that he could not understand the meaning of all this news. He was only in a hurry then, as quickly as possible, to leave these places where people were killing each other, to some quiet refuge and there to come to his senses, rest and think about all the strange and new things that he had learned during this time. But as soon as he arrived in Orel, he fell ill. Waking up from his illness, Pierre saw around him his two people who had arrived from Moscow - Terenty and Vaska, and the eldest princess, who, living in Yelets, on Pierre's estate, and having learned about his release and illness, came to him to walk behind him.

During his recovery, Pierre only gradually weaned himself from the impressions that had become familiar to him. last months and got used to the fact that no one would drive him anywhere tomorrow, that no one would take his warm bed away, and that he would probably have lunch, and tea, and dinner. But in his dreams, for a long time he saw himself in the same conditions of captivity. Pierre also gradually understood the news that he learned after his release from captivity: the death of Prince Andrei, the death of his wife, the destruction of the French.

A joyful feeling of freedom - that complete, inalienable, inherent freedom of man, the consciousness of which he first experienced at his first rest stop, when leaving Moscow, filled Pierre's soul during his recovery. He was surprised that this inner freedom, independent of external circumstances, now seemed to be abundantly, luxuriously furnished with external freedom. He was alone in a strange city, without acquaintances. Nobody demanded anything from him; they didn’t send him anywhere. He had everything he wanted; The thought of his wife that had always tormented him before was no longer there, since she no longer existed.

- Oh, how good! How nice! - he said to himself when they brought him a cleanly set table with fragrant broth, or when he lay down on a soft, clean bed at night, or when he remembered that his wife and the French were no more. - Oh, how good, how nice! - And out of old habit, he asked himself: well, then what? what will I do? And immediately he answered himself: nothing. I will live. Oh, how nice!

The very thing that tormented him before, what he was constantly looking for, the purpose of life, now did not exist for him. It was no coincidence that this sought-after goal of life did not exist for him at the present moment, but he felt that it did not and could not exist. And this lack of purpose gave him that complete, joyful consciousness of freedom, which at that time constituted his happiness.

He could not have a goal, because he now had faith - not faith in some rules, or words, or thoughts, but faith in a living, always felt God. Previously, he sought it for the purposes that he set for himself. This search for a goal was only a search for God; and suddenly he learned in his captivity, not in words, not by reasoning, but by direct feeling, what his nanny had told him for a long time: that God is here, here, everywhere. In captivity, he learned that God in Karataev is greater, infinite and incomprehensible than in the Architect of the universe recognized by the Freemasons. He experienced the feeling of a man who had found what he was looking for under his feet, while he strained his vision, looking far away from himself. All his life he had been looking somewhere, over the heads of the people around him, but he should have not strained his eyes, but only looked in front of him. Tsvetkov Nikolay Alexandrovich

Nikolay Tsvetkov is an entrepreneur, Advisor to the Chairman of the Board, Member of the Supervisory Board, Chairman of the Supervisory Board of URALSIB BANK.

Assets

From 1995 to October 1997 - Vice President for Finance and Investments - Head of the Main Directorate for Financial and Investment Activities of the Oil Company LUKoil.

Since 1997, he began to develop the NIKoil Financial Corporation, the core of which became the Joint Stock Bank “NIKoil Investment Banking Group”.

In 1997 - Advisor to the Chairman of the Board for Investment Banking Operations of JSCB Rodina.

Since 1998 - Deputy Chairman of the Board for Investment Banking Operations - Head of the Resource Attraction Department. JSCB "Rodina"

Since August 1998 - Chairman of the Board, member of the Board of Directors, member of the credit committee of JSCB IBG NIKoil.

Since June 25, 1999 - Chairman of the Board of Directors of the Novorossiysk Commercial Sea Port.

Kopeyka has a new owner

Social and political activities

In 1995-1996 - member of the Expert Council of the Federal Commission for Securities and the Stock Market (FCSM).

Awards

Based on the results of 2000, the NIKoil Financial Corporation was named the Laureate of the National Business Award and recognized as the best financial corporation of the year in Russia. Laureate of the “Banker of the Year – 2000” competition.

Nikolai Tsvetkov was born on May 12, 1960. Near the village where Nikolai grew up, there was the Tushinsky airfield. Therefore, like all his peers, he watched with admiration the elements of aerobatic aircraft taking off and dreamed of becoming a pilot. But most of his friends, after graduating from school, went to study at vocational schools or joined the army. However, Nikolai Tsvetkov did not give up on his plans and chose a different path. He entered the Tambov Higher Military Engineering School, where they trained high-class specialists. In 1980, Tsvetkov graduated with honors. Deciding to continue his education, Nikolai Alexandrovich entered the Air Force Academy. N. E. Zhukovsky. In 1988, Tsvetkov graduated from the course with a gold medal.

After some time, Nikolai Tsvetkov left to serve in Afghanistan. Galina Tsvetkova had to go through many anxious days and nights worrying about her husband. Fortunately, the Afghan campaign came to an end and the Soviet officers were returning home. At the age of just over 30, Nikolai Alexandrovich already had the rank of lieutenant colonel in the Air Force. But changes in the country with the advent of the 90s radically affected the army. The monetary and material support of the military deteriorated sharply, so Tsvetkov had to think about leaving the army. At that moment, the family actually lived on the salary of his wife Galina, who worked in the post office. So the decision was made to move to Moscow, where Nikolai began teaching.

After leaving the ranks of the military, Nikolai Tsvetkov worked for more than two years at the Moscow Institute of Radio Engineering, Electronics and Informatics, teaching science at the military department. Not forgetting about his own self-education, he simultaneously studies at the Russian Economic Academy. Plekhanov on a management course.

Tsvetkov Nikolai understands: in order to provide a decent life for the family, it is necessary to rebuild and take new drastic measures. He is actively involved in the study and prospects for the development of the country's stock markets. So, in 1992, together with a friend, he created the investment and consulting company Brokinvest. It is noteworthy that the entrepreneurs did not have their own funds for the authorized capital, so it was decided to contribute to the fund the village house of Tsvetkov’s wife near Moscow. So from 1992 to 1993. He worked as vice president of the company.

An educated stockbroker, Nikolai Tsvetkov, very quickly comes to the conclusion that the most promising business is the one in which you work for yourself. In 1993, he decides to create his own investment company. It was called “NIKoil” and specialized in working with oil.

A little earlier, fate brought Nikolai Alexandrovich together with Vagit Alekperov, president of the Lukoil oil concern. The latter was in great need of people who were well versed in investment and business issues. So Tsvetkov’s company began to deal with investment and financial issues of Lukoil, and he himself became head of the concern’s securities department.

During his time at Lukoil, Tsvetkov gained wide popularity among domestic businessmen. Despite the successful cooperation with the Lukoil concern, Nikolay Tsvetkov realizes that his own business requires further development. He sees the path to success in the area of client money management. Therefore, in 1996, the entrepreneur decided to purchase the small commercial bank Rodina.

Proof of the businessman’s successful work was the awarding of the title “Best Banker of the Year” in 2000. In 2002, Nikolai Tsvetkov was also named the best manager.

In 2002, Nikolai Alexandrovich acquired shares of Avtobank, whose branches numbered more than a hundred points of sale in different regions of the country. The year 2003 was marked by the largest purchase of the regional bank Uralsib.

As a result of the restructuring, which lasted more than one year, Tsvetkov’s business is being rebranded, giving it a single name - Uralsib. In 2009, the entrepreneur’s personal fortune was estimated at $2 billion 300 million. According to Forbes magazine, in 2011, Nikolai Tsvetkov occupied the 27th position in the list of the 200 richest businessmen in Russia. FC Uralsib had over 100 offices in 81 regions of the country.

Over the 10 years of its work, the Victoria Charity Fund has been able to provide support to more than 12,000 children in difficult situations. life situation. Various programs and projects of the fund covered almost 400 children's institutions from 47 regions of the country.

Since 2013, when the Central Bank began an active audit of the banking sector, FC Uralsib began a difficult period. As it turned out, the losses significantly exceeded the bank's income. There was a need for additional capital injection. The Central Bank issued an order to revaluate assets and reserve about 17 billion rubles.

Nikolai Aleksandrovich Tsvetkov retained a 14% stake in the bank; the businessman’s personal fortune is currently estimated at $200 million.